amanda more

-

Posts

180 -

Joined

-

Last visited

Content Type

Profiles

Forums

Events

Posts posted by amanda more

-

-

Amanda , Upon the supposition of a nephew ,

If my nephew borrowed $1000 for use in business and it was a simple loan , I would take it that he would be in debt to me for $1000 but the business did not represent me . If my nephew sold a part of the ownership of a business to me for $1000 , I would then assume that the business' dealings were partly in my name . I would question the debts the business was making and if I thought they were excessive I would make it known . In my simple view I have always thought that a business is only worth what would be left over if it shut down and paid off all it's debts . Morally , in my opinion , to close a business leaving many other business' to absorb any losses is wrong . Lawfully , owners may be protected , if somebody like my nephew said he couldn't pay my $1000 back to me , I would steal the wheels off his car .

Businesses can make a ton of money with few assets. Your uncle let's you set up a sweatheart lease for you only to sell magazines in a corner of his store. So, with few expenses you take in a thousand dollars a day. You send most of the cash profit back to the rest of the family in the old country. There is no money in the business. There is a value, however. Customers stop on their way to the train. There have been no bugs in the candy bars. There is then "goodwill." If you decide to leave town and go to graduate school, you have only your inventory to sell anyone. Your uncle may, however, set up another lease with someone else. You may have carefully invested thousands on flyers getting people to stop by your store and they have also patronized your uncle's store. If you decide to take your candy bars and go to college with them then your uncle is not liable to the people you owe the bill to. But he also can't just take your leftover candy bars because you operate there. It used to be you could get a price on a business with manufacturing equipment etc. and a fire sale book value. In a service based economy, it is hard.

If they close that train entrance for repairs for the next five years, what happens then to whatever value your magazine stand has?

The value of a business is very different from any hard assets. Mostly based on anticipating sales and profits in the future.

0 -

Amanda ,

Should stock market participants be responsible for what happens to a company's losses just as they are responsible for it's profits ? Should they always operate in credit , making any losses covered by collateral ?

Suppose your nephew needs a few bucks to get by. If you invest a $1000 in him are you then on the hook for the $10000 he owes? A corporation is set up so all we lose is the $1000 we invest and not on the hook for the company.

So as the stock market tanks, it should give some solace we are not required to pay more than our bets.

This has to be the way for arms length transactions where we cannot directly be there to run the company day by day.

In a partnership it is generally assumed that the partner who puts in the most gets most of the profits and is on the hook for the higher percent of the debts. But you are directly involved there.

It will be interesting to see which corporations go to 0 in stock and bond value.

Currently DOW is 10,662 and dropping. Psychologically that is looking way too close to 10000 so I see the rate of fall accelerating.

For the second part that ability to borrow to buy stocks was a huge reason for the Great Depression. You are right that failure to regulate ways of buying stocks for pennies and owing the value is very destabilizing. There used to be rules against it. More of the "sheriff left the town" of the last 30 years gutted those rules. It has turned stocks into very, very wild speculations.

Reason: People have so disconnected from the stocks as goods and services that they are unable to evaluate them based on the companies themselves. Computers programmed to look only at the numbers exacerbate it and produce bubbles and crashes.

0 -

he r

he rThat definately puts it into bear market. Is that bear going to turn crash. What do you think?

Reason: Hovering near 10000 for the DOW in what is already a bear market will cause a psychological tumble once it drops below 10000 for a strong drop i.e. crash.

0 -

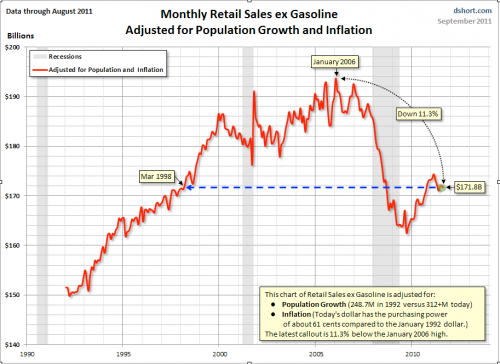

If that big drop is supposed to mean something, then you are almost 4 years too late with your warning. I've highlighted the time period in question — roughly when you posted your warning. That little circle on the end. We saw a 50% drop in the stock market when monthly retail dropped by $25 billion. Explain again how scary that blip is supposed to be.

"A government report Thursday morning on new claims for unemployment benefits will give traders news on the country's jobs crisis — one of the major economic challenges cited by the Fed.

Ninety minutes before the opening bell, Dow Jones industrial average futures are down 211 points, or 1.9 percent, at 10,796. Standard & Poor's 500 index futures are down 24, or 2.1 percent, at 1,131. Nasdaq 100 futures are down 43, or 1.9 percent, at 2,202.

Read more: http://moneywatch.bn.../#ixzz1YgWw7PEE"

I don't really understand scary. A small upturn that starts to then decrease could signal a downturn. The retail sales show it hasn't returned to a robust level and may then continue to decrease or go up and down around a lower average level. Like a sine wave or the market has been doing.

The market is currently down.

Reason: Figure with average 3% drop (could include 4% rally) per day in 7 days that is a 21% drop. Trading rules may stop sales at a single day there is a formula for hours stopped and percent so a 10% drop so then 7 times 3 is 21 plus 10 is 31% total drop by October 2. Psychologically the dow is now at 10,800 so after a 8% drop it goes below 10,000 making it likely that a selloff will decrease it further as everyone becomes aware that it has dropped.

0 -

You still haven't come up with convincing reasons why one should expect a 50% decline. But, even under the assumption that one might occur, why would it be any different than the 50% drop we saw in 2008/2009? i.e. a recovery of almost all of the drop over the course of several months? If I'm not in the market, I lose the opportunity for all that gain. I'm not buying stocks when they are the cheapest. My dividends are nonexistent, and don't get reinvested on the cheap.

What do I do with my newly-expanded cash position? Where can I get more than a percent or two return on it? I've seen the crash of '87 and the one after the new millennium/9-11 in addition to the housing bubble crash. The market recovered each time. My investing horizon is longer than the next year or two. If it wasn't, I shouldn't be in stocks.

This is a chart which shows what most of us can basically already understand. This isn't much of a recovery. It could be a new normal.

The stock market hates stagnation as iNow has pointed out. The technical term is lost 'opportunity cost'. If money is pulled out of a stock at $100 and it goes up to $20 then it will be a lost opportunity to make $20. The only reason I can guess that one might predict a 20% increase in stocks is that one is looking backward to some former price. That is not how it works.

My mom has the same outlook on everything based on her expert rating in Duplicate Bridge (Buffett, Gates play it) In bridge if you bid seven and make it and the other tables bid five and make it you win and they lose. But if you have a vase that in the top market made $700 and now sells for $500 it is a different story. $500 is a whole lot better than zero and not that different from $700.

You have actually not lost $200 and even if you paid $700 that is meaningless for the value. The vase is being exchanged for the asset as a vase and the asset as cash. Houses, everyone now realizes aren't worth $350,000 as some kind of hard number. A good is actually worth what others will buy. It doesn't matter if, historically, it was worth a million. The past is the past. If you sell, then you are then stuck with the value you sell for your books. But the sales price is independent of what you paid for it and you are actually not any more or less rich.

In a 50% crash one might look at a cash position that makes 0% as a boon. By math you would have 100% more than if you had stayed. Do you have a stockpile of nonperishable food? I guarantee if you shop the bargains and keep a pantry of $1000 worth it will never be worth 0 and I would assure it would go up at least with general inflation. That beats the market.

Reason: At some point the 401k and IRA investor will finally realize what the rich have realized- the stock market is a bad bet.

0 -

Check your 401k. Don't fall for it saying govt stated stuff that could still mean mortgages. Your plan could have the opportunity to buy CD's in it. These are government guaranteed. The trick is to not pay the penalty for removing from 401k and instead leave it there.

If your 401k does allow with like five day notice for parking your money in a CD fund then if you are going to do it, do it now before October. Otherwise you will lose principle as stocks tank. You can always then switch some back to stocks after the crash. A rule I recall is at age 30 30% in cash, at 80 80% in cash (CDs would be considered close to cash) The average person only has 75000 in retirement I recall so this is too little money to be gambling totally on stocks. At one point savings were negative so Americans couldn't have built up much of a nest egg elsewhere n the last few years even at 6% of income on savings now.

"401k

-

A 401k is a retirement plan named after the section of the Internal Revenue Code authorizing it. These plans are typically employer created and sponsored. A 401k plan allows a wide range of investment options, although the investment options for any particular plan are governed by the administrator's investment selections. Most 401k plans allow for investments in mutual funds and some 401k funds authorize the investment in CDs. Like mutual funds, investments in 401k plans are not insured and can and do lose value."

The IRA is much easier and can be switched to CD's easier. Bank CD's are government insured by FDIC.

There has to be some honest funds which are mainly US treasuries which are primo but good luck finding the exact mix in the documents. In order to attract returns I think they get heavy in munis- anyone hot to invest in Detroit today?

So -you don't need to pull from the plan and pay penalties- just switch much of your risk away from stocks and into CDs.

It is your money- after all. Why is this strategy rarely mentioned? The people you see in the financial media are the salespeople.

0 -

A 401k is a retirement plan named after the section of the Internal Revenue Code authorizing it. These plans are typically employer created and sponsored. A 401k plan allows a wide range of investment options, although the investment options for any particular plan are governed by the administrator's investment selections. Most 401k plans allow for investments in mutual funds and some 401k funds authorize the investment in CDs. Like mutual funds, investments in 401k plans are not insured and can and do lose value."

-

Here is the news:

Longitudinal evidence that fatherhood decreases testosterone in human males

In species in which males care for young, testosterone (T) is often high during mating periods but then declines to allow for caregiving of resulting offspring. This model may apply to human males, but past human studies of T and fatherhood have been cross-sectional, making it unclear whether fatherhood suppresses T or if men with lower T are more likely to become fathers. Here, we use a large representative study in the Philippines (n = 624) to show that among single nonfathers at baseline (2005) (21.5 ± 0.3 y), men with high waking T were more likely to become partnered fathers by the time of follow-up 4.5 y later (P < 0.05). Men who became partnered fathers then experienced large declines in waking (median: −26%) and evening (median: −34%) T, which were significantly greater than declines in single nonfathers (P < 0.001). Consistent with the hypothesis that child interaction suppresses T, fathers reporting 3 h or more of daily childcare had lower T at follow-up compared with fathers not involved in care (P < 0.05). Using longitudinal data, these findings show that T and reproductive strategy have bidirectional relationships in human males, with high T predicting subsequent mating success but then declining rapidly after men become fathers. Our findings suggest that T mediates tradeoffs between mating and parenting in humans, as seen in other species in which fathers care for young. They also highlight one likely explanation for previously observed health disparities between partnered fathers and single men.

http://www.pnas.org/...9/02/1105403108

My question is - is this result related with the culture? Why they do this in Philippines?

I think one way to think of this is the ritual fighting that birds etc. go through during mating times in order to get access to females. T needs to be high for that. Although T is higher in males than females it is not the sum total of male identity. Human culture is a cooperative herd tribe evolutionary progression. Continued high testosterone in many species would be counterproductive to that. A continuous high 'roid human would have trouble hanging out with the tribe. So higher and higher steroid males would not have been selected for. In apes in order to get a female to get fertile and get busy a male can kill the baby she is holding in order to make her available. That is not the baby's father.

Single males may also be considered more expendable. They are famous for risk taking. Out on the hunt they may help the tribe out. So higher Testosterone helps the tribe get more meat. Once they start fathering then that and home tribal activity becomes important also and risk taking more problematic for his mate and the tribe.

I doubt this has anything to do with the Phillippines only.

Men often assume women go for the biggest,strongest most buff guy. Yet they are continually puzzled with the choices women actually make. In order to coexist high 'roid is counterproductive for a relationship especially. A crying baby is a stress that needs a different chemical mix to have a chance to handle.

0 -

Found this very early 1 AM Tuesday Sept 20

"Standard and Poor's cut its unsolicited ratings on Italy by one notch to A/A-1 and kept its outlook on negative, a move that took markets by surprise, warning of a deteriorating growth outlook and damaging political uncertainty.

"It only adds to the contagion risk over Greece and has encouraged the flight to safety in markets here,"

Japan's Nikkei share average fell 1.4 percent, partly catching up with falls elsewhere on Monday when Tokyo markets were closed, while MSCI's broadest index of Asia Pacific shares outside Japan fell 1.3 percent.

The MSCI index is in bear market territory -- traditionally defined as a fall of 20 percent or more -- after sliding 22.3 percent from its 2011 high in April.

S&P 500 index futures fell 0.8 percent, pointing to a weaker start on Wall Street after U.S. stocks fell around 1 percent on Monday."

http://af.reuters.co...lBrandChannel=0

"Markets can remain irrational a lot longer than you and I can remain solvent." Keynes (attributed- not directly quoted)

0 -

And so it starts. We already have seen the effects in that bastion of wild behavior, England. This is a simple protest on Wall Street and they closed off the street on Friday.

I recall sociology saying that if people are very poor there is actually less social unrest. So this may now be a volatile mix of just poor enough.

When a family doesn't have gas to make it to the food bank at the end of a paycheck they may still be able to swing by downtown for different protests. This food price thing is so sudden everyone is still beating themselves up that it is their fault. That can't last.

0 -

Reason: The economy is tanking (causing stock market crash) do to these zombie ideas that will not be killed despite all the crashes and data to the contrary. From "Zombie Economics," The Great Moderation, The Efficient Markets Hypothesis, Dynamic Stochastic General Equilibrium, Trickle Down Economics, Privatization. Economists themselves are to blame for letting these ideas generate a life of their own.

Here is URL and has more extensive review plus page preview of zombie economics:

0 -

Hi:

I'm thinking of theoretical treatment for obesity and some of it's associated illnesses. This treatment involves the use of strains of bioengineered bacteria.

Here is website of ascaris infection for weightloss http://www.telegraph.co.uk/news/newstopics/howaboutthat/7195990/Hong-Kong-dieters-warned-over-swallowing-parasitic-worms.html

There is some history to this, Just naturally I read 25% have parasite infections in much of the world so it has been a way to have lower weight.

Supposedly other parasites can cause weight gain on some sites.

This shows an interesting correlation between part of the immune system and obesity.

http://www.ncbi.nlm.nih.gov/pmc/articles/PMC2947244/.

I can't tell what happens with weightloss and inflammation. Is it that weightloss makes you kind of sick? Most feeling sick is an immune response to say a cold virus not the virus itself.

So an infection that causes an inflammatory response could by itself cause weightloss or weight gain. Never mind the type of cell it targets.

There is a shot taken for weightloss that mimics the throwing up women do in the first three months of pregnancy.

Farout. Wrong. Probably. But under the knife makes how much sense really?

0 -

I just tried to google but I recall people getting infected with parasites, losing weight then curing the infection. Gross, yes. But slicing and dicing with something like 2% fatality is also very wild,

0 -

This is a survey of bankers and accountants from august 2011 to this month september 2011. They had been optimistic back in January but are not now. That site I quoted on the GDP is a bit confusing. It says from quarter to quarter but a yearly basis. Then in another graph on something else it says quarter to quarter values. Since i don't think last year had like 12% GDP growth then this is very bad GDP. So, for .4% then 1.0% if then the next two quarters are 1% does this mean .1% plus .25% plus .25% plus .25% so a GDP of then a little over .85%? This is real GDP so they try to get a handle on inflation and it is after inflation. Inflation has to be a bit hard to measure. Bought a Big Mac lately? Looks like half the size it used to be. So if it held its price then it wouldn't show up as de facto costing twice as much.

Reason: Economy has already tanked although government numbers don't fully show it easily. Historically, the stock market tanks in October.

0 -

I think that philosophy can still be useful in the field where science hasn't been completely established yet.

For example, in the field of Artificial Intelligence, a known thought experiment is Turing Test which was designed by philosophical method. In such experiment there are a human subject, a machine with artificial intelligence, and a human judge. All of them are separated from each other, say, in the separated rooms linked together with computers. The judge can only tell which the machine is by reading the emulating human response. If the judge cannot discriminate which is which, it means that the machine passed the test. The original test designer, Dr. Alan Turing, believed that the machine passed the test can think.

The study of ethics falls within philosophy. Although the philosophy group I go to rarely emphasizes it. Science needs lots of liberal arts around it and philosophy is one of those areas.

They do talk of Hume and the philosophy of science. I think one thing that appears to cause many to turn from science is that it is so ethically neutral. There is a point to that. Hopefully, scientists themselves don't take pride in being ethically neutral and aren't.

0 -

It's because they've decided to withdraw spending. They are retracting, and being austere. The market wants them to invest and grow. That's the opposite. This is pretty straight forward.

I can quote it but with the downsizing of newspapers there is a downsizing of reporters who cover science and technology and then also the dismal science-economics.

So the inability for the "everybody else" to understand our difficult complicated technical society has decreased- at least in this mass media.

I have only now started watching Bill Maher. One reason so many of us don't vote and turn away is because it is just such a bummer. I like that there is a way to get interested and learn without getting very,very blue about it.

Along those lines I am reading this great book, "Zombie Economics" by John Quiggin. It gives me hope that it is possible to popularize the more factual take. He has a great cover and he is a lively writer. I enjoy the writing but then after 40 pages realize it is still for the more voracious nonfiction readers like me.

He discusses the different ways that Europe and other countries also bought in to these ideas. And continue to.

Reason: The economy is tanking (causing stock market crash) do to these zombie ideas that will not be killed despite all the crashes and data to the contrary. From "Zombie Economics," The Great Moderation, The Efficient Markets Hypothesis, Dynamic Stochastic General Equilibrium, Trickle Down Economics, Privatization. Economists themselves are to blame for letting these ideas generate a life of their own.

0 -

It's likely that amanda has confused the source, and that even if she heard it on NPR, the comment was probably from a person being interviewed, not from a commentator.

This is bordering on distasteful on your part.

A commentator I would think would include in the general sense those who are invited on a show. They certainly call those who are political. political commentators. Your obviously intense dislike of any level of hyperbole might be better directed to others.

This is so simplistic as to be intuitively obvious to the most casual observer. Politically, calling out reality is not in vogue. That may have always been true and it may be hopeless. But my personal search is to understand how extensive that is, why that is, and how light can be shed on dark corners. I started out wondering why science was so often absent from policy or misused. I may or may not publish a book on it.

It is very 'head in the sand' for scientists and technologists to not see that what is well known and acknowledged in their areas finds pervasive ignorance everywhere else.

Is it their inability for simple discourse? Even about something as mundane as food prices and availability? One wonders. As true as that may be I blame the "everyone else" to refuse any understanding of simple arithmetic. That is more of a mystery to me.

Perhaps you should buy my first book. Instead of this conversation it is, of course, more rigorous and I would love to discuss this actual topic "Eating on $1" in amazon.

One upside an economics type can mention is if the economy tanks, will food then get cheaper? I am concerned the possible stagflation may make things very dire indeed. Food supply for those Americans in need may be especially endangered by wrongheaded governors looking to cut the tiny , hole-filled safety net in place now. The new drop of the middle class into poverty should result in some kind of lessons learned should they climb out.. The Depression had, although not mentioned much in my textbooks, food riots. Could that be in our future?

0 -

Highly unlikely. As I've shared with you before, inflation has been below 2% for 32 straight months.

"I haven't actually watched, but he probably did X. Isn't that just like him?" What a really monstrously stupid thing to say, amanda. Try watching or reading the speech before commenting next time, will ya? Some of us prefer to live in actual reality, not the one people manufacture in their heads.

Watch: http://www.whitehous...s-act-get-facts

Read Highlights: http://www.whitehous...es/jobs_act.pdf

Read Overview: http://www.whitehous...et-and-overview

Read the Entire Speech: http://www.whitehous...ession-congress

Check out their slide show: http://www.slideshar...-jobs-actslides

Also, while related, a plan to create jobs does not need to include a plan to address childhood hunger. These are separate topics, so it should be understandable if the president did not mention that one specific thing in this specific venue. You know what? He also didn't reference space flight or immigration or the military. So what? Those are different topics.

Monstrously stupid? your comment " What a really monstrously stupid thing to say, amanda."

Now those are siilly words. A commentator on NPR yesterday said it took him two days to find one reference to poverty in an Obama speech. (2009)My point here is the "you can't change what you don't acknowledge"as I continue to belabor. My comment was more like - "if it is as usual even in a speech about jobs, he would have studiously avoided the deep damage that a crashing economy has on people- namely poverty." I had skimmed the transcript and the summaries. How monstrously stupid would it be to not realize that simple facts regarding this reality is studiously avoided by all sides?

It is now hitting the news that the census report shows poverty. Surprise.

Inflation below 2% and if I read real GDP it is also under 2%. They always try to leave out food and fuel but what do families have to buy? More data does not necessary result in always better reasoning. That is a particularity of an American bias.

-1 -

Hi everyone,

I am applying to neuroscience/neurobiology PhD programs that would start Fall '12, and I am looking for some guidance/comments/tips/assurance. I generally have competitive spec's for an applicant, but I am missing a lot of relevant coursework; I would like to know how realistic my goals are.

The type of research I am interested in is more towards the genes/molecules/cells end of neuroscience and definitely not anywhere near the psychology end of neuroscience. The problem is that I don't have much science coursework under my belt, which may limit my goals. I am enrolled in some science classes to start catching up, but I am afraid it might be too little and too late.

[i apologize ahead of time for being so long-winded].

Hi,

I kind of envy you.

It is too bad I had long decided not to teach. A pleasant cozy PHD program would have been nice.

You are so motivated that I think you will have little difficulty.

So I wonder where the world needs you most?

It is amazing what an easy read books on the brain are. It would be hard for an author to make them dull. But if you have done some of that let me suggest pubmed.gov It isn't that hard to identify the margins of knowledge from the books. Then use search terms on pubmed. See what cutting edge research you might already have some insight in. See which schools have done what.

That is the hard way though. Easier to talk a prof from the school you went to to get you in to a conference. The bars at conferences are great.

I think it is kind of neat that Madame Curie was slaving away turning pitchblende into radium while working on a PHD.

The cutting edge stuff is more experimental and so those laser tuned to getting their PHD's would often be chagrined to not have it pan out. Experiments don't always work.

I'm trying to think what I personally would like to see. Less neurotoxic pesticides. Cures for MS and MG. Autism. Alzheimer's. These have been either proven or somewhat shown to be autoimmune. I suppose for diseases then neuroimmunology is and will be huge. There is little appreciation for the tolerance that happens with antidepressants but I witnessed it in a loved one. This would then lead to science of addiction. Obesity also.

I kind of surprised myself here. Comparative physiology is amazing so it is astounding what can be done with fruit flies,frogs,rats. Basic knowledge of the neurology itself can show when and how it goes wrong.

Good luck. Oh and I would encourage you to slosh through differential equations( I assume you've had statistics). A lot of bio types could use a bit more math.

0 -

Most cars already have dehumidifiers. They are called air conditioners.

I have been interested in scaling down of commercial dehumidifier/desiccants for residential use.

A car as opposed to a house must quickly get filled with outside humidity. A car that sits does get moldy in many climates.

One can buy those little jars filled with desiccants if the car sits. Indeed air conditioners knock out humidity as they lower it to the temperature that holds less humidity. So it would be cheap to turn the air conditioner on in the car while a jar of desiccant sits in it. The desiccant would take a while to work, then fill the car with perfumed air quickly? I think it would be better to kill the mold too though. A pan of chlorox has some effect on it if it evaporates but can't be splashed anywhere.

The commercial models can be recharged- left to dry then used again to hold moisture. The jars can only be used once.

All the under water cars from the midwest/northeast I have assumed were goners. But maybe there is a way to reclaim them.

0 -

Well, I guess a lot here are not very european centered.

I am so used to understanding econ 101 that the fed moves to prevent great depressions that I was puzzled by the Euro to begin with.

So it seemed inevitable that fed style monetary policy would have a hard time working with so many countries and the same currency. So was this too inevitable? They must have thought the block of Europe would lend a hand helping exports and economic prosperity in Europe and then selling to outside Europe.

Perhaps germany thought there was this huge advantage preventing the devalueing of neighboring currencies. At some point the poorer countries with say a lire get very cheap indeed compared to deutschmark? Anyone followed this?

Reason The stock market tanks as Europe tanks.

0 -

It's helpful when one distinguishes quotes from original writing a little more distinctly. Italics, colors and quote tags are all available options.

Because facts don't matter to many politicians & pundits, to too many people (especially if there is a collision between the facts and an ideology), and increasing, to the journalists that frame the stories, when they treat opinions and facts on equal footing.

Well, at least I finally quit rerepeating quotes

At one meeting this guy said "studies show" and it was just in a group who nodded and were ok with just that. He was saying it so he sounded like a big guy.

For a response which would say," really that counters studies I've read?" is very socially verbotem.

No one likes the science guy. It appears to be some kind of buzzkill. I am very puzzled but it appears that "winning" without much facts on your side appears to increase bravado not chagrin. It reminds me of the bully in the schoolyard who says "cause I am telling you this." So the less real substance the more it shows you are getting what you want from throwing your weight around.

Is there anyway to en mass require from "those who run us" more than third grade sandbox tactics. If so, how? The study I mentioned was very good. It let the bigwigs in each town know they were passing by 700,000 food insecure humans - in their town. A buy in by the 2% that hoards so much wealth like Buffett mentions may be the only hope. Today's top 20% blue next 20% red next 20% green

http://www.pbs.org/newshour/bb/business/july-dec11/makingsense_08-16.html

Wow, where is the middle class today? It wasn't always thus. Reality is a bummer. Even the fat cats can't be happy to drive by all those food-insecure. Are they powerless to change? This kind of poverty is never going to be addressed by food banks.

I am fascinated by the behavioral economics guys. Anything they ever say about putting people back to work or incentivizing the rich to quit funding electing more rich to make them more rich?(and some of that cash is 'reverse robin hood' from the rest of us)

Obama's speech: Saving teacher's jobs will prevent that multiplying effect on job losses in communities. Cash in paychecks for those that have them is a help. The infrastructure stuff takes too long doesn't it? If we can fund wars bypassing congress can a president executive order if need be? The GDP and inflation numbers keep getting revised but appear to be getting ever closer. Will they announce next year that for this year any growth was actually only inflation?

Haven't heard the whole Obama speech but I imagine he left out food uncertainty in children. Figures.

And clueless pundits call it a Obama reelection campaign so does that mean causing total economic meltodown destroying many of us would be a Republican campaign strategy?

0 -

Please don't "cut and paste quote" something without adding your own thoughts. While not exactly against the rules, we'd much rather discuss things with members rather than authors who can't respond.

You missed the " but thanks for confusing my writing with that of a professional journalist. Any thoughts about why scientists can't motivate politics with facts?

0 -

Those are not easy questions, but I'll take a guess. The problem is so large that it seems overwhelming, and we tend to avoid thoughts which cause us distress when we as individuals can't reasonably take action to resolve that cause. Since we so often feel we cannot fix the hunger problem ("I am but one man, what can I truly do to even make a dent?"), we ignore it because we don't like the inner turmoil an despair that deep consideration of such issues cause within.

http://www.npr.org/2...unger-rate-down

"Every day more than 700,000 people in Harris County are uncertain about where they will get their next meal. Not all of them are poor — many are working people who don't qualify for federal food programs.

These are among the findings of a recent study that provides the first detailed look at hunger at the county level. Harris County families struggling to keep food on the table have a food budget shortfall of $12.97 per week, per person. To fill the meal gap, $277 million is needed annually to ensure that every person has three meals a day, according to the report's calculations.

The federal government defines food insecurity as limited or uncertain availability of nutritionally adequate foods. On average, food insecure families go at least seven months of the year without enough food, the study said."

Families are key here. As guys take off they are still considered able bodied. I would like data on how many out of work singles qualify for food stamps per state. Michigan a college student qualifies while Florida he would have to have a disability. So help is lenient for kids and yet . . .

The giveaway I saw had families with $20 of food that had to travel to a location. Food stamps are quick, efficient and make it not insurmountable. How much would it cost to give every nonworking or minimum wage adult $200 a month for food? The earned income credit is a type of welfare for the working poor but now that mechanism is faulty when so few work and they really need kids to benefit.

I also wonder if we are getting through the baby boomlet so perhaps less kids- less hungry kids.

How is this hard? Just feed people. That stimulates the economy because they are in that wonderful category that is so hand to mouth they will not hoard cash. They can't. That improves the money supply.

Let's see $300 million for Houston a welloff oil rich city. My city doesn't have traffic jams anymore like Houston still does. Population what 4 million people. There are 320 million people in the USA so times 80 is 24 billion dollars. Really? Less than the budget of some counties. Is it one hundredth of what the "welfare for bankers program" got? And they hoard the cash not stimulating the economy. Where are those who run us and can't they talk? If not, why not?

The silence is deafening.

0 -

I just think there is a whole aspect of this that truly goes right over my head. The newspaper shows a program where families show up and get a paltry bag of groceries. The article goes on to show the studies which show that 30% of todays children in the United States are food insecure and also - in my county!

I am mystified. Truly.

Who do you know that wouldn't be appalled by that? If not, why not? Isn't this just logical common consideration to make sure every child goes to sleep on a stomach that isnt gnawing with hunger.

What do guys say when they wake up at Paneras over coffee and see it? How about them Bulls?

If so, why so?

Is it psychiatric? Is it a social norm gone haywire? Is it too real for life? Are scientists not just studying the actual shortage but this huge disconnect ignoring it? Is it the sudden 30% drop in church attendance so no one has someone to tell them to get a conscience?

As soon as one acknowledges reality must one pick a team? If so, why? Who can argue in favor of having hungry children? If so, is that someone you would even want to sit next to on a bus?

0

Why is The American Stock Market going to crash?

in Politics

Posted

Well, perhaps I could ask for some clarification.

I was just reading about a paper having to do with "the commons" that was published in the late sixties. It talks against the idea that the "invisible hand" of the market always works in some kind of sainted manner(Adam Smith).

My contention and a fairly universal one is that jobs are important. A sick economy has to effect the stock market. The weird attitude to do business as before as some kind of saving grace does puzzle.

From Wall Street Journal regarding this weekend September 24: http://online.wsj.com/article/SB10001424053111903703604576589210888153064.html

"The broad market declines have added pressure on finance ministers and central bankers as they gather for the International Monetary Fund's annual meeting in Washington this weekend.

"We are in a red zone," said World Trade Organization chief Pascal Lamy, one of many officials attending the meeting. "We are at risk of repeating what happened in 2008"—when market upheaval shook the global economy—"occurring again for different reasons but through the same channel, the financial system."

So you are saying that the lack of banking itself- making loans etc. is a huge problem. I hadn't really thought that it hurts the banks themselves because if bankers don't do banking then it hurts them. Makes sense though. Pretty dire words above.

And as congress again %$^*s up with weird disconnected stuff with yet another sandbox fight it seems-

Does anyone hear Nero playing as Rome burns?

Reason: The weirdest most disconnected nuttsiest politicos to ever inhabit the House tug just hard enough to get a teetering economy to crash as they continue to party hardy for themselves and their party. Meanwhile those that know warn of another economic crash. Anyone OK with more "reverse Robin Hood" especially fattening bankers and taking bucks to New York instead of feeding the 1 in 7 food insecure Americans?